Payroll & Finance

What the Upcoming Tax Changes Mean for Your Payroll Processing

June 23, 2024

In the recent budget announcement, the New Zealand government announced some personal income tax changes that will take effect on July 31, 2024. But, what does this mean for running payroll and paying your employees?

Here’s the TL;DR version: Some employees will be taxed slightly less due to the new thresholds. For employers who use PayHero, there’s nothing you need to do. The tax changes will kick in automatically for any pay runs set to 31st July or after.

Let’s break that down further.

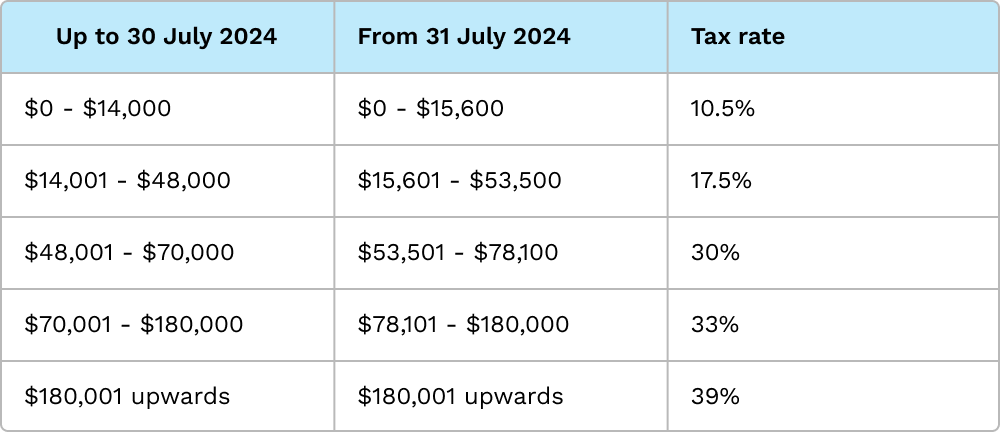

New Income Tax Thresholds

The personal income tax thresholds will be adjusted as follows:

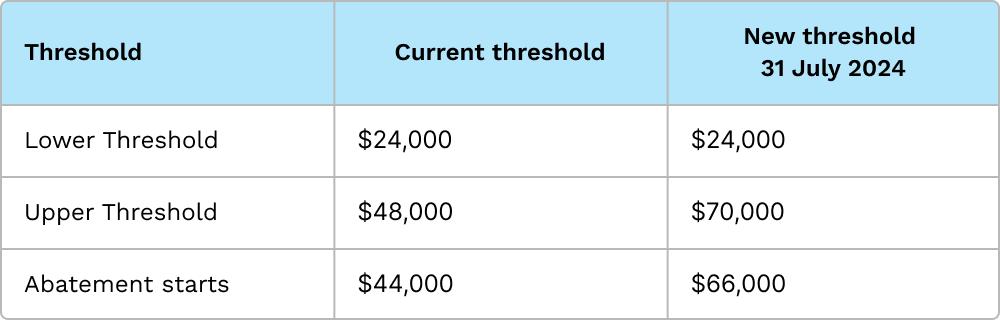

New Independent Earner Tax Credit Thresholds

The thresholds and amounts for the Independent Earner Tax Credit (IETC) are getting updated too, including the abatement threshold at which point the credit amount starts to reduce:

Other Things to Keep in Mind

The tax rates for lump sum payments like bonuses and redundancies will not be changing until 1 April 2025. For PayHero users, we will automatically apply any updates to the appropriate Pay Items when necessary.

Review if any employment agreements and policies need updating due to the tax changes.

You might like to communicate the changes to your employees so they understand any impacts on their take-home pay.

What You Need to Do

The good news is that PayHero users don’t need to do anything. We will apply all the new tax rates for you so your pay run and payday filing can be processed like normal. However, as always, make sure all your employees’ tax codes are up to date. The new thresholds will be used for any pay with the pay date 31st of July or onward, even if part of the period was before the effective date.

If you use other payroll software, your provider should push an update with the new rates before July 31st. If you do payroll manually or don't use software, make sure to apply the new tax rates from that date.

Unsure if your payroll system is up to the challenge? Come on over to PayHero. Thousands of Kiwi businesses use our award-winning, compliant payroll software. We can help with the transition and get you going before the tax changes roll in. Sign up here for a free 14-day trial.